How To Save $5,000 In 6 Months: 5 Best Ways

Are you trying to find the best way to save money quickly? Find out how to save $5,000 in 6 months!

I found what worked best for me and I’m so excited to share it with you.

Once my husband and I closed the deal on our new home, creating an emergency fund became essential.

We’d spent so much of our cash for the down payment that we needed to replenish the emergency fund ASAP.

The thought of something going wrong in our home that could be extremely expensive gave me nightmares.

Then something unexpected happened.

Property Taxes!

Our property taxes went way up from the year prior, so this inadvertently made our mortgage increase by $500/mo.

I instantly contacted the bank to find out what we needed to do to bring our mortgage back down to what it was before.

With our emergency fund in place, it helped us to pay the property taxes outright and bring our mortgage back down.

If we didn’t have our emergency fund, it would have been a snowball effect pushing us into a paycheck-to-paycheck lifestyle.

I promised myself I’d never live paycheck-to-paycheck again and I meant it. If you’ve ever been in that situation before, you know exactly how unsettling that is.

Long story short, I needed to build our emergency fund back up to $5,000, and fast. Unexpected things will come up and it’s just good to be prepared when they do.

So, I’ll share the strategies that have worked for me on how to save $5,000 in 6 months.

How Can I Save Money Fast in 6 Months?

1. Use the Zero-Based Budget (ZBB)

I found that using a zero-based budget was really effective when it came to saving.

Zero-based budgeting (ZBB) is a budgeting approach that involves developing a new budget from scratch every time (i.e., starting from “zero”), versus starting with the previous period’s budget and adjusting it as needed.

That way every cent is accounted for in your budget and whatever is left over goes to savings.

The key component that helped me save money fast and get an in-depth understanding of my finances was using this annual budget template that automatically calculates my totals and clearly shows my total earnings, expenses, and how much I’ve saved by the end of the year.

This way I was able to see what month I’d reach my savings goal to make sure it was indeed within 6 months and adjust accordingly if needed.

I checked in on this weekly and it really does help you to stay motivated because you can actually see the finish line.

This post contains affiliate links, which means I may receive a small commission at no cost to you if you make a purchase.

2. Use a Separate Savings Account

If you’re like most Americans, you probably only have 1 savings account and 1 checking account.

Sometimes it can be tricky to successfully save money unless it goes into a separate account designated specifically for saving.

Plan where you want the savings to go.

One thing is certain, LIFE happens and we will sometimes need to make adjustments.

And while you can, it’s just a lot easier to know how much you have in your account for this challenge.

3. Cut Out Unnecessary Bills/Subscriptions

The best way to save money is not to spend it.

But we all know, there is indeed a cost to living.

When you do a deep dive into your budget you’ll be able to see where you’re able to cut some unnecessary expenses by using the annual budget template or you can use Trim.

Trim is a digital personal assistant that makes it easy to save money on your monthly bills. All you have to do is sign up here and Trim will do the heavy lifting for you. Trim will also negotiate your monthly bills, such as your cable, cell phone, and internet bill. Trim works behind the scenes and automates various ways for you to save money.

Now you can have more money in your pocket to help grow your savings and pay off debt faster.

Since we’re still on the subject of cutting your bills. Do you really need Cable?

It may be time to re-evaluate if you really do need it. How often do you watch and how much do you spend? Make sure you find time to call your cable company and try to negotiate a better rate. If you don’t want to, just let Trim do it.

How Many Months Will it Take to Save $5,000?

Depending on your situation, you may be able to save $5,000 in 3-6 months.

Although there are many factors that play into how long it could take to save $5,000. Save what you can, while you can. There is always going to be some reason or need to spend the money.

If you’ve got quite a few expenses it could take around 6 – 8 months.

4. Save Money On Groceries | Meal Plan

Do yourself a favor, do a little research on how much you spent on food last month.

Did the grand total surprise you?

One of my biggest tips is not to impulse buy.

Try not to buy those “name brand” items at the grocery store. Sometimes the ingredients are exactly the same and the only thing you’re paying for is the brand. And don’t forget to check out Coupons.com to see if there’s an opportunity for you to save money on the items you’re already purchasing.

Most grocery stores offer some type of savings each week, so keep a lookout for those each time you shop.

I suggest following these best practices to shop smart for groceries:

- Grocery Shop Alone or Online – Get ONLY what’s on your list without impulse buying or grocery shopping without a plan. Don’t shop while you’re hungry.

- Shop Your Pantry – I know some folks are cabinet hoarders (I’m guilty too.) If you are, GREAT, because you can save by cooking meals you already have the ingredients for.

- Couponing – Get instant savings by taking a few minutes to clip coupons. If you haven’t downloaded it yet, use Ibotta. If you’re shopping online, make sure to use Rakuten. I’ve earned over $700 using Rakuten (in real life).

- Meal Plan – I know meal planning isn’t for everyone, so if you need help, consider joining the $5 meal plan. For just $5 a month, they will send you a delicious meal plan where every meal will cost about $2 per person, and in most cases even LESS. It’s a great way to eat well for less. You can try it FREE for 14 days here.

- Cash Back Credit Card – When you shop, use your cash back credit card. It makes sense to earn if you have to spend money (which we all do). I earn over $500/yr with my AMEX. You can earn $250 within 6 months! You can apply here.

If you rather meal plan on your own, we’ve been using this meal planner that helps keep us on track. One of the top reasons I love this meal planner is that I can add things to my list from my phone.

Before we move on, make sure you check out this list of 15 things I stopped buying to save money. Maybe you can do the same.

Do yourself a favor while on this savings journey.

Write down a reason for saving $5,000 in 6 months. That will help motivate you while you’re working to save.

What is the Quickest Way to Save $5,000?

The quickest way to save $5,000 is by increasing your income.

5. Increase Your Income

![]()

Pick Up A Side Hustle

The more money you earn, the more money you’ll be able to save.

Picking up a side hustle helped me earn and save over $7,000 in profit in less than a year doing it part-time.

Yes, I said over $7,000!!!

It’s amazing what you can learn online.

It’s much easier to save when you have more money to play with. So picking up a side hustle outside of your everyday job is a great way to get to achieve this goal.

Below are the 5 platforms and ways that helped me add $1,000+ to my monthly income doing it all part-time.

- Amazon

- eBay

- Mercari

- Poshmark

- Blogging

The great part about these side hustles is that you can do it too! You could earn much more than I did if you stay consistent and motivated.

If you’re considering selling on Amazon, be sure to check my 5 Best Tips: How To Sell on Amazon FBA For Beginners.

Reselling online is obviously not for everyone, so consider other side hustle ideas like Blogging, Proofreading, or Transcribing.

If you need more side hustle options, make sure to check out this list, the 10 best side hustles to start today.

To recap, below is a bullet list of a few ways how you can save $5,000 in 6 months.

- Budget efficiently by using the zero-based budgeting method.

- Reduces expenses by $300+ each month.

- Open a separate savings account so you know exactly how much you’ve saved for this challenge.

- Subscriptions/Memberships: Canceled unused subscriptions and memberships.

- Limit Grocery Store Trips: Meal plan weekly and limit store visits. Cook only what you need and eat leftovers.

- Stop Getting Takeout Food: Cook at home and meal plan instead.

- Credit card rewards: Redeem credit card rewards to help fund the things you cut from your budget.

- Increase income with overtime or a side hustle to make an additional $500+ a month.

- Transportation: Consolidate trips (gas prices are WILD). Walk or bike if you can.

- Make Home as Comfortable as Possible: Doing things nowadays can be really expensive. Gas prices are soaring and the cost of food is too. It’s more cost-effective to stay at home to save more money.

How Much Do I Need To Save To Have $5,000 In 6 Months?

When writing this article, I thought about how much you need to save $5,000 in 6 months. Your income levels are different than mine, I’m sure, but the answer will always be the same.

If you’re trying to save $5,000, that will always be the end goal.

You’ll need to save $5,000.

The answer is simple. But getting there can be a little challenging.

Below are a few different methods I put together to help you find out how you can save $5,000 in 6 months.

Methods To Save $5,000 in 6 Months

Here are a few different methods to follow. Select the one that works best for you and your family.

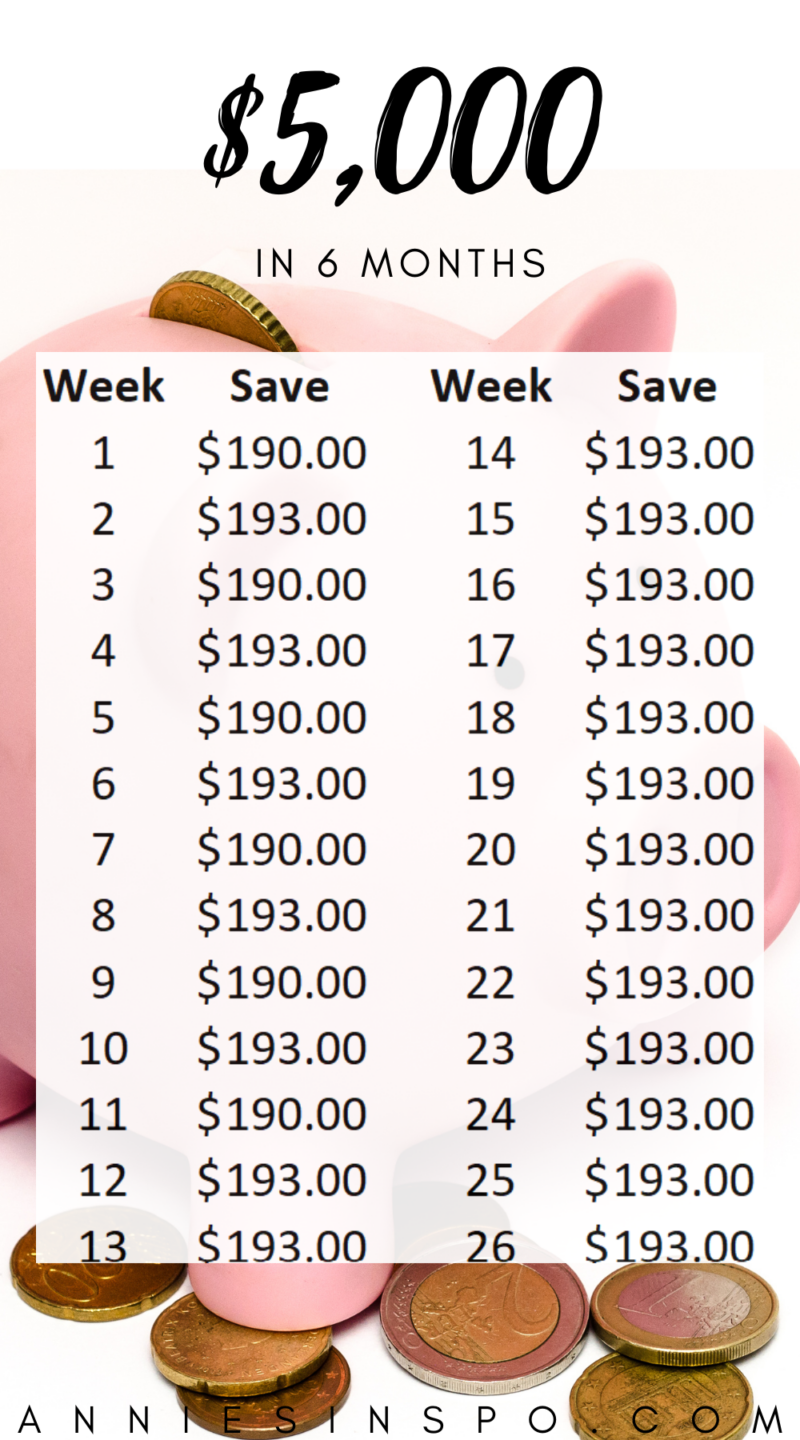

Method 1 – How To Save $5,000 weekly in 6 Months

If you are paid weekly, this would be a good template to follow.

In the event, you’re partnering up with your spouse on this challenge, make it a team thing so the weekly deposits won’t hurt so bad.

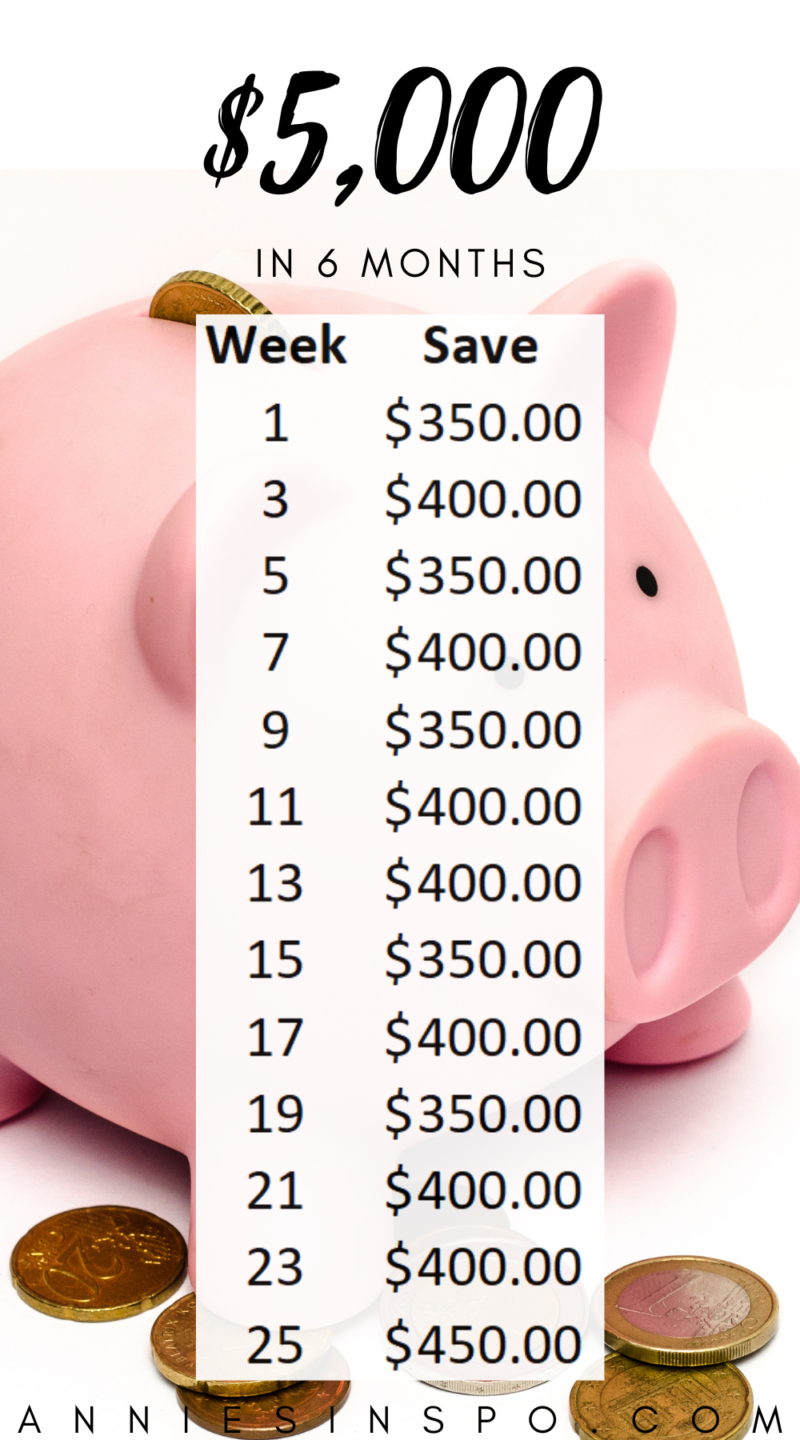

Method 2 – How To Save $5,000 Bi-Weekly in 6 Months

This is the method I used.

I was very strict during this savings period.

You must be committed, or it won’t work.

Every payday, I would pay all the bills for that period and move the money over into a separate savings account.

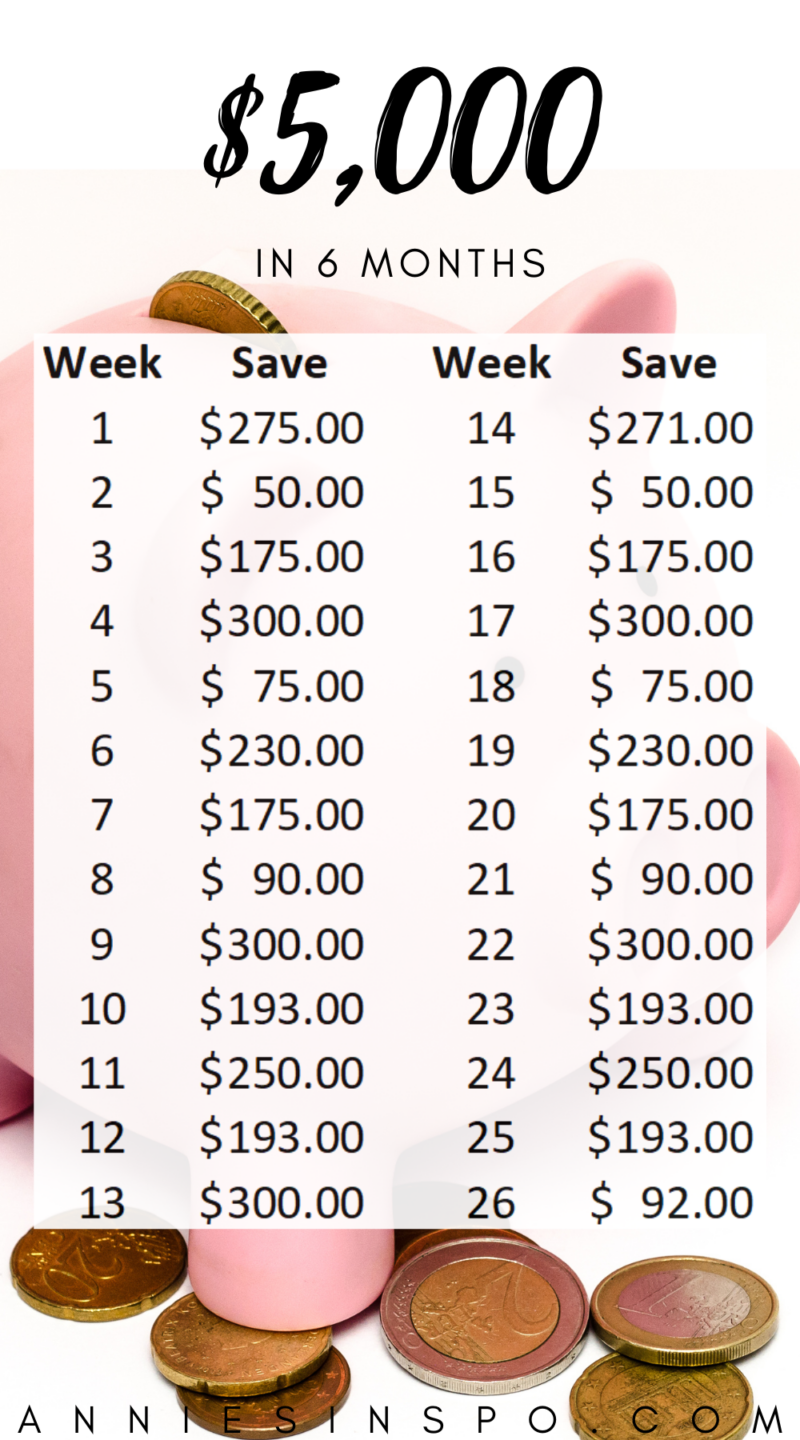

Method 3 – How To Save $5,000 in 6 Months Sporadically

Sometimes, when life happens we have to adjust and go with the flow.

I like the sporadic amounts because even if you aren’t able to save one of the larger deposit amounts one week, you can substitute it with a lesser amount and make it up in a few weeks.

I hope you learned some new ideas that maybe you had not thought about before from my personal journey of how to save $5,000 in 6 months. You can do it too!

To learn more about finding Great Ways to Save or Make Money, Subscribe to my mailing list, or follow me on Instagram.